north dakota sales tax refund

Starting at just 19month for sales tax preparation. Taxable sales and purchases for January February and March of 2022 were 47 billion.

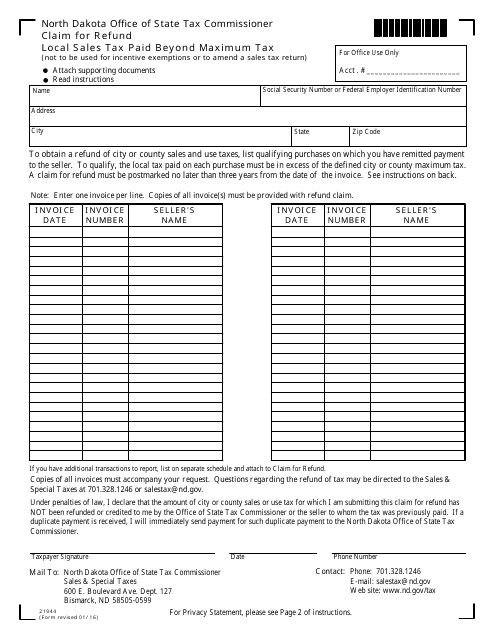

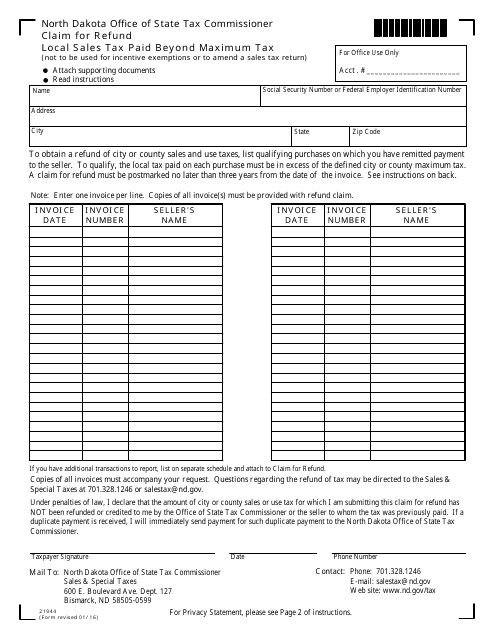

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

Form NDW-M - Exemption from Withholding for a Qualifying Spouse of a US.

. Please note that if you file your North Dakota sales taxes by mail it may take significantly longer to process your. Direct Deposit If your bank refuses a direct deposit of a refund we will mail a paper check to you at the address listed on your return. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 35.

Manage your North Dakota business tax accounts with Taxpayer Access point TAP. The sales tax is paid by the purchaser and collected by the seller. This allows you to file and pay both your federal and North Dakota income tax return at the same time.

North Dakota Offi ce of State Tax Commissioner PO Box 5527 7013281241 taxregistrationndgov Bismarck ND 58506-5527 TDD. E-Filing Free Filing. Refund Applied to Debt North Dakota participates in income tax refund offset which provides that an individual income tax must be applied to reduce a debt you may owe to a state or federal agency.

Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges from 0 to 45 across the state with an average local tax of 096 for a total of 596 when combined with the state sales tax. The sales tax rate for North Dakota is 5 percent plus the applicable rate for local jurisdictions. North Dakota sales tax is comprised of 2 parts.

New local taxes and changes to existing local taxes become effective on the first day of a calendar quarter. The maximum local tax rate allowed by North Dakota law is 3. Gross receipts tax is applied to sales of.

Ndgov Cory Fong Tax Commissioner NNoticeotice Sales Tax Request For Refund - Canadian Resident May 5 2009 In recent months the Tax Department has received a considerable number of sales tax. North Dakota sales tax payments. Refunds Things to Know.

Currently combined sales tax rates in North Dakota range from 5 to 8. Sales Use and Gross Receipts Tax Return to the following address. Ad Avalara Returns for Small Business can automate the sales tax filing process.

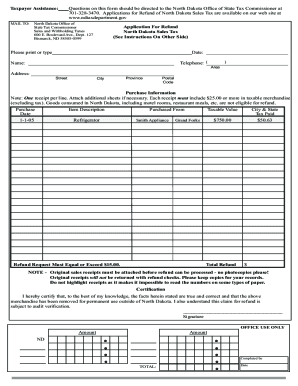

The claim for refund must include copies of all invoices to support the claim. Form 306 - Income Tax Withholding Return. Canadian residents may obtain a refund of North Dakota sales tax paid on qualifying purchases those purchased to be used exclusively outside the state.

Taxable purchases must be a least 25 per receipt and the refund request must be at least 15. Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the first quarter of 2022 are up 132 compared to the same timeframe in 2021. Additionally the state reduces the tax rate for business taxpayers purchasing new farm machinery for exclusive agricultural use to 3 percent and new mobile homes to 3 percent.

North Carolina Department of Revenue. No matter what method you use to file tax preparer software you purchase or one of the Free-File options here. Amended Returns and Refund Claims.

State Sales Tax The North Dakota sales tax rate is 5 for most retail sales. How to Get Help Filing a North Dakota Sales Tax Return. A claim for refund must be filed with the North Dakota Office of State Tax Commissioner Sales and Special Taxes 600 E.

Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes. North Dakota individual income taxpayers you can also utilize TAP to make electronic payments check the status of your refund search. Updates are posted 60 days prior to the changes becoming effective.

Name phone number ZIP code and a detailed explanation of your question. The use tax works in conjunction with the sales tax. North Dakota participates in the Internal Revenue Services FederalState Modernized E-File program.

You can start checking on the status of your return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return. Salestaxndgov North Dakota asks that you please include the following information in your email. Office of State Tax Commissioner.

Goods consumed in North Dakota including hotel rooms and dining are not eligible for a refund. PO Box 25000 Raleigh NC. North Dakota Department of Taxation issues most refunds within 21 business days.

Taxpayers may also file North Dakota sales tax returns by completing and mailing Form ST. Instantly Find Download Legal Forms Drafted by Attorneys for Your State. To qualify for a refund Canadian residents must be in North Dakota specifi cally to make a purchase and the goods purchased must be removed from North Dakota within 30 days of purchase for use permanently outside of North Dakota.

Sales and Use Tax Revenue Law. Start your free trial today. TAP allows North Dakota business taxpayers to electronically file returns apply for permits make and view payments edit contact information and more.

How can we make this page better for you. You can lookup North Dakota city and county sales. Thursday June 23 2022 - 0900 am.

Form 307 North Dakota Transmittal of Wage and Tax Statement - submitted by anyone who has an open withholding account with the Office of State Tax Commissioner and does not file electronically. Written Determinations Sales and Use Tax. 127 Bismarck ND 58505-0599.

How to File Sales and Use Tax Resources. North Dakota first adopted a general state sales tax in 1935 and since that time the rate has risen to 5. Ad The Leading Online Publisher of National and State-specific Legal Documents.

Form 301-EF - ACH Credit Authorization. Furthermore refunds are available only on taxable purchases of 2500 or more. North Dakota imposes a sales tax on retail sales.

Lastly here is the contact information for the state in case you end up needing help. You may check the status of your refund on-line at North Dakota Tax Center.

Millions Of Businesses Small Medium Are Withheld From An Employee S Paycheck A Portion Is An Expense To T Sales Tax Goods And Service Tax Goods And Services

This Graph Shows The Average Tax Refund In Every State Tax Refund Tax America Map

North Dakota State Flag 14x11 Aged Print By Patriotislanddesigns 29 50 Flag Prints State Flags North Dakota

North Dakota Nd State Tax Refund Tax Brackets Taxact

How To File And Pay Sales Tax In North Dakota Taxvalet

How To File And Pay Sales Tax In North Dakota Taxvalet

Form 21944 Download Fillable Pdf Or Fill Online Claim For Refund Local Sales Tax Paid Beyond Maximum Tax North Dakota Templateroller

North Dakota State Print Art North Dakota Flag North Dakota Etsy Flag Prints State Flags North Dakota

North Dakota Tax Refund Canada Form Fill Out And Sign Printable Pdf Template Signnow

How To File And Pay Sales Tax In North Dakota Taxvalet

How To File And Pay Sales Tax In North Dakota Taxvalet

Https Www Thebalance Com Thmb Adcl9oxxhq2bqfmqfd7scukhyps 1333x1000 Smart Filters No Upscale States Without An Income Tax 36d1d40465 Income Tax Income Tax

Ndtax Department Ndtaxdepartment Twitter

Nd Form St 2016 2022 Fill Out Tax Template Online Us Legal Forms