philadelphia wage tax refund 2020

Please dont call us a week after you file for your refund she said. The new NPT rates for calendar year 2019 are 38712 percent 038712 for residents and 34481 percent 034481 for non.

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

In an article published on February 7 2021 in The Philadelphia Inquirer and Lancaster Online Jennifer Karpchuk Chamberlain Hrdlicka SALT.

. What Is Philadelphia City Wage Tax. 2020 Year-End Tax Planning Tips. All Philadelphia residents owe the Wage Tax.

2020 Philadelphia City Wage Tax Refunds. Philadelphia Tax Attorney Offers Strategies To Save Taxes Before Year-End Philadelphia Requires Businesses Give Notice To Employees Of Philadelphia Wage Tax Refund Program Federal Earned Income Credit By February 1 2021 New Tax Relief for Those Taxpayers Experiencing COVID-19-related Financial Difficulties. As of January 8 2021 the City of Philadelphia has not updated their portal with a Wage Tax Refund Petition Form for 2020.

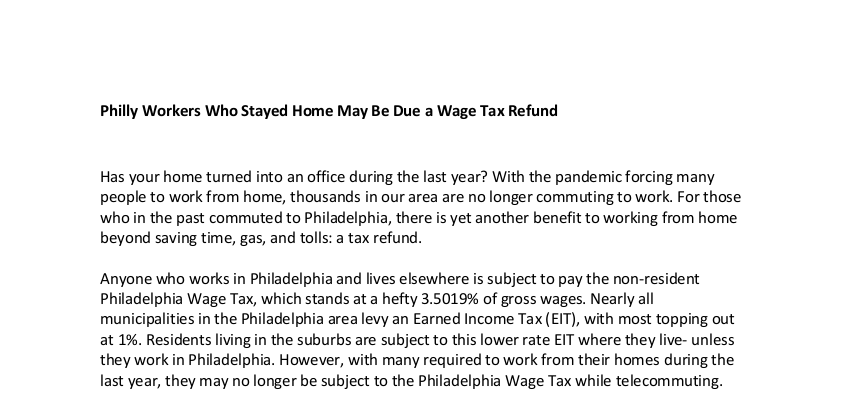

Visit Corporate Tax Compliance and Payroll. The refund is allowable only for periods during which a non-resident employee was. Those refunds are being issued as many suburbanites continue to work from home.

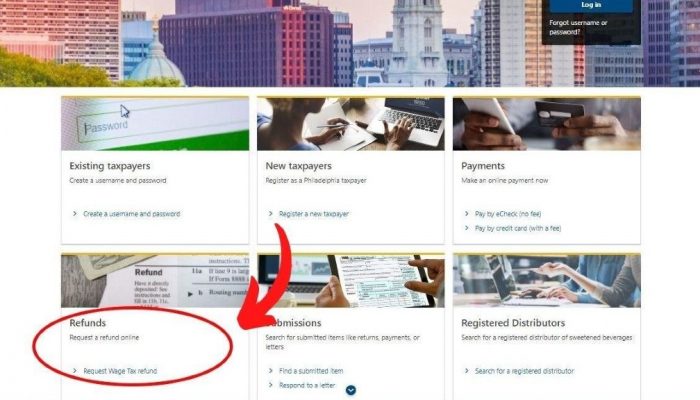

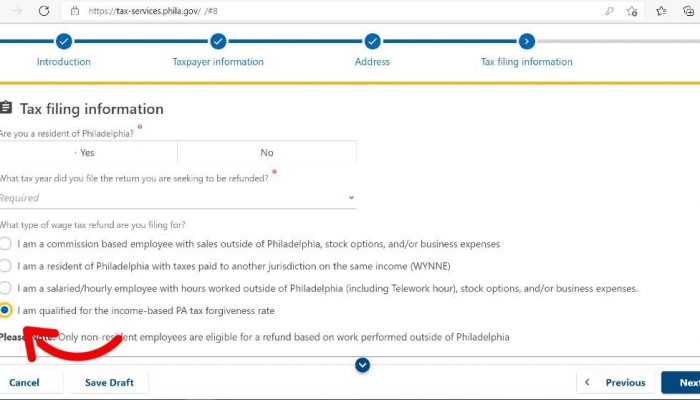

If youre approved for Tax Forgiveness under Pennsylvania 40 Schedule SP you may be eligible for an income-based Wage Tax refund. You can now also request any Wage Tax refund online. Because the City of Philadelphia is expecting an extreme increase in the number of refund petitions for 2020 they have attempted to make the process easier.

She predicted a six- to eight-week wait for a refund. 9 rows 2020 Wage Tax refund Dates and Locations Template non-residents. How to file and pay City taxes.

Wage tax refund in say June of 2021 for 2020 taxes withheld after I file my 2020 NJ taxes when I amend my 2020 NJ return could I still be subject to the same penalty and. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. Electronic funds transfer EFT Modernized e-Filing MeF for City taxes.

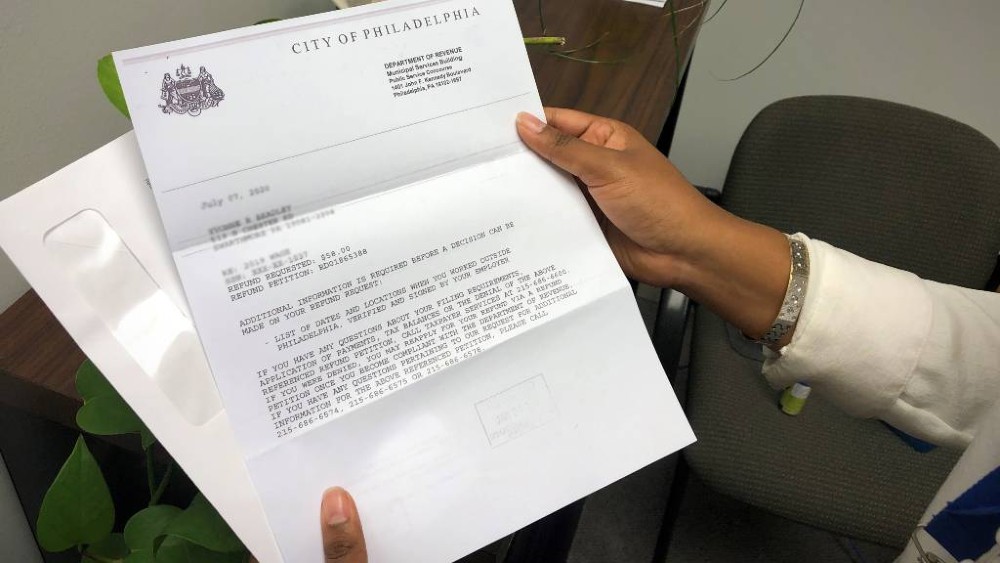

Make an appointment for City taxes or a water bill in person. Interest penalties and fees. 2020 COVID EZ Phila CWT Refund Letter.

Wage Tax refund requests for 2020 can be submitted with accompanying W-2 forms starting in 2021. Hi ErnieSO I think I know the answer to this question but along these same lines. The department is staffing up she said in the departments All About Wage Tax Refunds video on YouTube.

While Philadelphia residents are eligible for refunds of City Wage Tax if they paid tax to other. Wed love to hear from you. Normally Philadelphia non-residents employed in the city can get a wage tax.

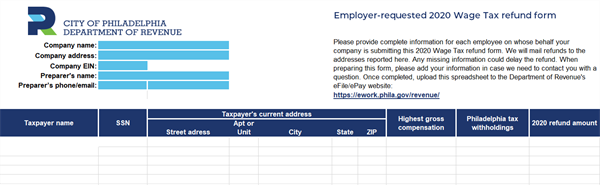

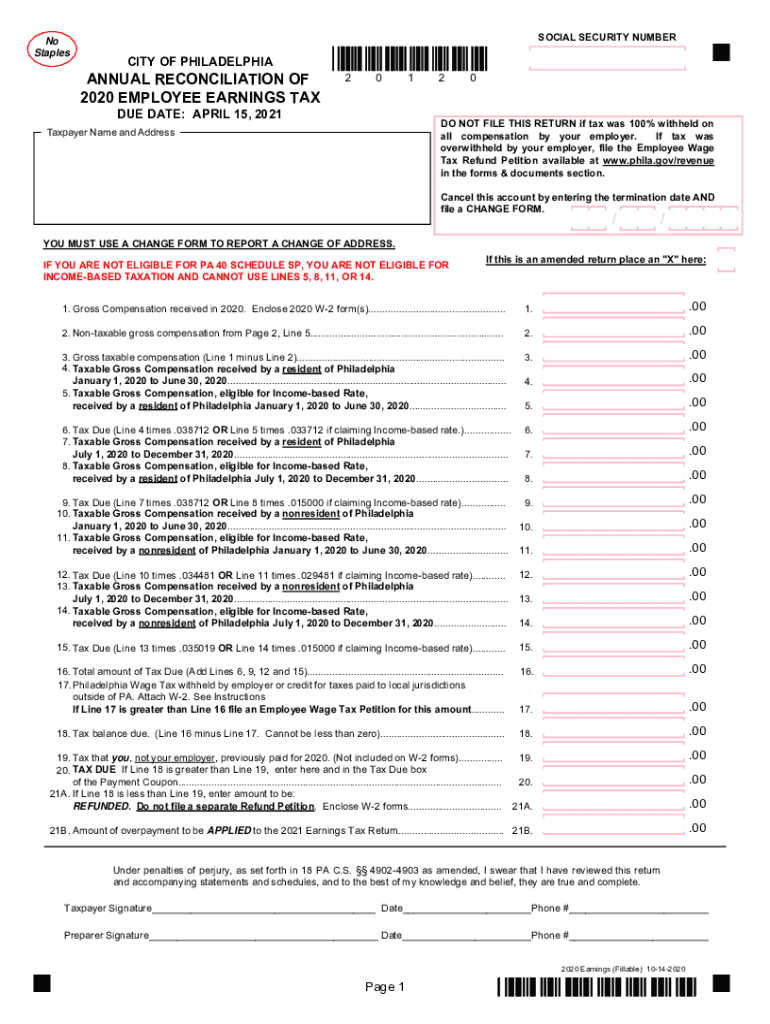

And finance officials estimate theyll refund a total of 105 million to nonresident commuters for 2020 by the time theyre done. July 1 2020 to December 31 2020 38712 038712 January 1 2020 to June 30 2020 34481 034481 July 1 2020 to December 31 2020 35019 035019 Statute of Limitations - any claim for refund must be filed within three 3 years from the date the tax was paid or due whichever date is later. In an article published on March 2 2021 in The Legal Intelligencer Shareholder Jennifer Karpchuk explains that for the first time the City of Philadelphia Department of Revenue is allowing employers to file a bulk return on behalf of their employees for 2020 wage tax refunds and creating a streamlined application for employees to file online.

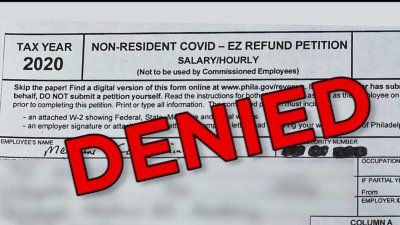

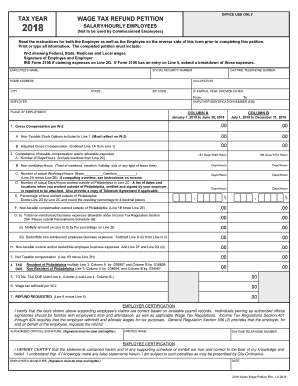

A taxpayer residents or non-resident with Pennsylvania Tax Forgiveness pays Wage Tax at a reduced 15 rate. Eligible nonresident employees may file a refund claim for the wage tax withheld while they worked from home as required by the employer during 2020. In view of major disruptions to business by the coronavirus pandemic weve created special Wage Tax refund forms only for 2020.

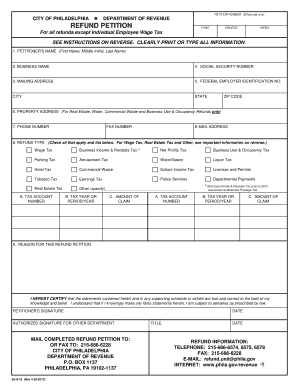

Prior to 2020 to request a refund of wage taxes paid employees had to file and submit a Wage Tax Refund Petition to the city. The Philadelphia Department of Revenue has provided more information about its Wage Tax policy for non-resident employees during the COVID-19 pandemic. These include an employer-requested form and simplified paper versions.

Claimants must include a copy of their W-2 along with a signed letter on employer. Philadelphia employers are required to give an income-based wage tax refund petition to employees at the. Employees are not eligible.

The City will refund Wage Tax that was withheld by the employer above the 15 discounted rate. Its going to be awhile. Tax forms instructions.

Heres the link. We expect the normal 6-8 week processing time to be longer this year. PHILADELPHIA WPVI -- So many people are working from home during the pandemic and that could impact your taxes.

2021 Philadelphia City Wage Tax Refunds. As of mid-August Philadelphia had sent checks to about 32000 people according to city spokesperson Kevin Lessard. Be certain your payroll systems are updated to reflect the increased non.

Pay delinquent tax balances. These forms help taxpayers file 2020 Wage Tax. If I decide to apply for the Phila.

Philadelphia City Wage Tax Refunds FAQs. The Philadelphia Department of Revenue is providing 2020 City Wage Tax refunds to non-city residents required to work from home due to the pandemic. The employee wage tax refund claim form will be available the first week of February 2021 via the City of Philadelphias website.

The refund is allowable only for periods during which a non-resident employee was required to work outside of Philadelphia either pursuant to City ordinance or employer policy. Philadelphia City Wage Tax 2020 -- claim NJ credit andor Phila refund. Practice Co-Chair discusses the city of Philadelphias wage tax refund for employees whose jobs were based in Philly but mandated them to work from home due to the COVID-19 pandemic.

Have recommendations or feedback. 2020 Philadelphia City Wage Tax Refunds for Non-City Residents Required to Work from Home Due to COVID-19. The City announced it expects to post the form during the first week of February on the Income-based Wage Tax refund petition webpage.

This form could not be filed electronically.

Philadelphia Wage Tax Refunds Delayed Due To 500 Increase In Applications Nbc10 Philadelphia

Request 2021 Wage Tax Refunds Online Department Of Revenue City Of Philadelphia

Covid Makes Everything Difficult But Philly Makes Tax Refunds Easier

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Delayed City Wage Tax Refunds Still Being Paid Nbc10 Philadelphia

Philly Workers Who Stayed Home May Be Due A Wage Tax Refund Newtown Township Bucks County Pennsylvania

Success Wage Tax Refund R Philadelphia

Wage Tax Refunds And Payment Plans Made Easy Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Refund Opportunities Tax Year 2020 Baker Tilly

How To File For The Philadelphia Wage Tax Refund Nbc10 Philadelphia

There S A New Tax Refund Available In Philadelphia This Year Philadelphia Legal Assistance

![]()

Philadelphia Wage Tax Refunds What S New For 2020 Plenty

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller

Pa Annual Reconciliation Employee Earnings Tax City Of Philadelphia 2020 2022 Fill Out Tax Template Online Us Legal Forms

Submit A Bulk Request For Philly Wage Tax Refunds Department Of Revenue City Of Philadelphia

Who Is Entitled To A Wage Tax Refund Department Of Revenue City Of Philadelphia

Philadelphia Wage Tax Petition Fill Out And Sign Printable Pdf Template Signnow

Philadelphia Wage Tax Refund Request Form For 2020 Wouch Maloney Cpas Business Advisors

Wage Tax Refund Petition 2020 Fill Online Printable Fillable Blank Pdffiller